By the end of the quarter, NAND flash memory price has been falling for seven consecutive quarters, resulting in a decline in the profitability of six manufacturers in the NAND field, but for consumers, the storage capacity of SSD hard drives and smart phones is even bigger and the price is lower.

The price of some flash memory in the channel market this week has increased more moderately than that in last week. The drop in NAND Flash price increase is due to the following reasons.

First, NAND Flash price went up too fast, which rose to 27% in less than a month, beyond the general price increase level. The phenomenon that supply-demand is imbalance is easy to take place.

Second, although the price increase was leaded by original factory, the price continued to increase sharply because of the market news and some customer stocking up production in the channel market.

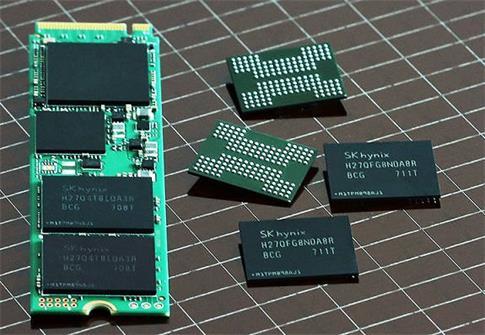

Third, as for the supply side, due to the poor demand in the first half of 2019, the inventory in the original factory continued to grow. Although the price increase stimulates the consumption of inventory, the 96-layer 3D NAND from original factory will be shipped in the second half of the year, so the market condition of oversupply has not improved. As for manufacturers like SK hynix and Micron, they have further narrowed their production scale.

Fourth, from the demand side, although entering the Q3 stocking period, US companies have also resumed partial supply to Huawei. Samsung and Apple new smart phone are released as scheduled. Compared to oversupply market conditions, demand for mobile phone, PC and other terminal customers seems to be weak. In addition, whether the terminal big customers can accept the price after rising is also the key point.

In addition to the changes in the NAND Flash market, the recent conflicts between Japan and South Korea, China and the United States have further deepened.

The contradiction between Japan and South Korea is still related to Japan’s export control to South Korea. As Japan decided to remove South Korea from the preferential treatment for export management “white list” on August 2, the contradictions between the two sides have intensified. Since Samsung, SK Hynix, LG and other Korean companies occupied an important position in the semiconductor industry, especially Samsung and SK Hynix's leading position in the storage market, it will have an impact on the entire industry.

The trade dispute between Japan and South Korea has affected the supply of DRAM. In the beginning of July, the Japanese government suddenly announced stricter export controls on the three chemicals necessary for the production of memory chips and mobile phone displays. South Korea is home to Samsung and SK Hynix, the world's two largest memory chip manufacturers.

China and the United States, as major economic country, their fight with each other will have huge impact on the industry. From the US’s ban on ZTE in 2017 to the ban on Huawei in May 2019, it has touched the nerves of the entire industry and also add variables to the development of the follow-up industry.

How will the price of NAND flash memory develop in the future?

In July this year, due to power outages at the Toshiba plant and disputes between Japan and South Korea, the spot price of flash memory rose. Since the price increase of NAND Flash at the end of June, the price of consumer NAND Flash has continued to rise for over one month, especially in the channel market, the price increase of products is the most obvious. According to ChinaFlashMarket quote, the consumer NAND Flash composite price index has risen by as much as 27% on August 2, consumer NAND Flash price per GB has also returned back to more than $0.06. In the face of market recovery, even DRAM has taken a ride on the price increase. However, the trend of flash contract prices has not changed, which is still falling.

For this problem, Pan Jiancheng, chairman of the SSD controller chip company Phison, recently expressed his views when attending an event. He believes that the inventory level of the manufacturers is still relatively high before the end of June, but in July and August, inventory levels have fallen with the growth in demand. Pan Jiancheng recently expressed his views on the market conditions of NAND Flash. Pan Jiancheng said that the system plant inventory level was high before the end of June. However, with the emergence of mobile phone rush orders, the system plant's inventory level at the end of July and early August has declined.

After a surge in NAND Flash prices in July, Pan Jiancheng said that NAND Flash suppliers are now reluctant to cut prices. It is expected that the system plant will launch a new wave of replenishment in October due to the end of sales season and US tariff issues. It will also launch a new wave of rise in NAND Flash price.

Pan Jiancheng predicted that after the price increase in October, the NAND flash memory market will encounter a low tide in Q1 next year, but with the growth of NAND Flash market demand, especially the demand brought by 5G, the supply side has limited growth due to reduce in investment. The supply from manufacturers is limited, and supply for flash memory will be tight in Q3 next year.

Pan Jiancheng said that it is becoming increasingly difficult for IC design is to make money because of the large amount of development investment, the need for long-term investment, the need for many engineers and the rising cost of operation and maintenance.