Is the Market Economy of RAM ruined by BM?

Is the Market Economy of RAM ruined by BM?

More moves are being taken in the stagy EOS.

Someone said that an average player could earn 60,000 EOSs a day on July 3rd.

Someone said that it was good to enter the market as the price is low now on July 4th

Someone said that to change parameters might bring chances for investors to buy and sell before price restores to market value in July 5th.

Someone said that he lost 500EOS due to BM, and earned nothing.

EOS increasingly becomes stagy.

A bitcoin which stands out among the coin world equates a villa with the annual highest growth reaching 1000%, while Ethereum focusing on technology sees 585%. They are put into shadow when compared with EOS RAM market, especially in the stage when the market stays bullish. RAM makes EOS the focus of market after the election of super nodes and multiple network coming online, it caters to many investors’ ambitions while making itself noticed. But surges and slumps are commonly seen in bitcoin world. Speculators are likely to feel extremely frustrated due to the change of RAM price during these two days.

1, how can RAM increase 40 times within a week?

Daniel Lairmer, founder of EOS released version EOS Dawn 4.0 in early May, and put forward a new memory distribution model based on market which adopts Bancor. This arithmetic, called as “班科协议”in Chinese, originated from Keynes plan put forward by Keynes, an English economist after the second world war. Britain with serious economic damage attempted to issue a world currency by setting up an international clearing union, made Bancor the accounting unit and evaluate with gold. The share of each country’s currency in the union was calculated at 75% of the average volume of import and export trade three years ago. They should cancel bilateral clearing to cripple the impact of dollar and American gold reserve. Whereas, America put forward White Plan to counterattack. Therefore, Britain with declining economy and military was put into shadow by America, the greatest creditor nation in the world. As a result, Keynes plan aborted, USA set up international Monetary Fund (IMF) in which fund money has a relationship with gold.

Keynes’s Bancor thinking was handed down though UK failed to jointly lead international finance with USA. One of Keynes’s followers practiced and upgraded the main idea of Bancor through code and made Bnacor agreement whose core concept is to match the needs of the buyer and the seller. Bancor agreement exchanges tokens through intelligent contracts and reserve currency in encrypted currency.

A fixed mathematical formula is used by this agreement to allow everyone to establish tokens which link up with some assets including gold, bitcoin and Ethereum at certain ratio. These assets are the reserve currency with tokens whose value can be gained therefrom.

The Bancor arithmetic has the following advantages:

Tokens priced based on the real situation of supply and demand in an open, transparent and predictable way.

Free of bidding, its exchange rate complies with its market value with a more in-depth efficiency of mobility.

There are no rivals and even buyers or sellers because trades are conducted between people and machine.

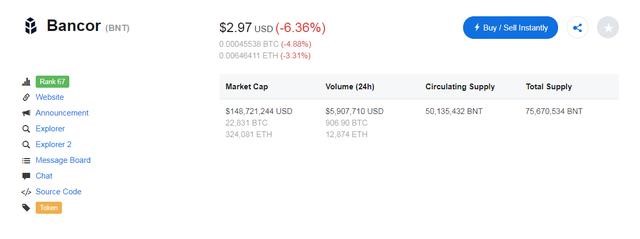

The ERC20 based on blockchains of Ethereum emerged in May, 2017. Known as Bancor (BNT), it became the first encrypted token to realize Bancor agreement. It enjoys the market value of 0.15 billion dollars, ranking 64th.

BNT made Ethereum the reserve token, set the hook ratio to 20%, and released BNT tokens by the intelligent contract of Bancor with reserve fund sent by ETH. Simply speaking, users use ETH to buy BNT though the intelligent contract, which adds the reserve of ETH. Therefore, BNT token is issued by the intelligent contract based on the fixed mathematical formula. Meanwhile, the value of BNT token will increase when the reserve fund increases. The intelligent contract will destroy the application and subtract the number of ETH you ransomed from the reserve fund when users ransom Ethereum at the cost of BNT.

I’m actually explaining how EOS issues RAM, however, memory can be reused but not destroyed. Users can redeem memory space by mortgaging EOS or ransom EOS by releasing memory. Therefore, RAM appeared speculative at the beginning, and people called RAM as the real estate of the market world.

RAM is a rare resource fundamentally because there is limited memory of single computer in EOS system. It is needed rigidly by users and developers, and it supports account opening and application development.

Who Controls the Rare real Estate of Bitcoin World?

Users with RAM can be divided into two kinds according to practicability and speculativeness shown by memory resources, namely developers on EOS chains and speculators who are actively squatting.

1, inchoate EOS developers

In EOS network, developers need some data when starting or developing DAPP. RAM is used to store these data. Memory of 4KB is needed to set up a new user. As participants who first know and have the greatest need for memory in the whole system, they have purchased some at a low price when RAM was released.

But we can find through eosmonitor that most major users of RAM hold the memory of several hundred MB. The one with the largest number have 1.76 GB which accounts for 2.75% of the total memory. However, they seldom use the memory with the average service rate being 3-4K. Nearly every user opens an account on EOS, and a few of them use space to develop.

(Data comes from eosmonitor)

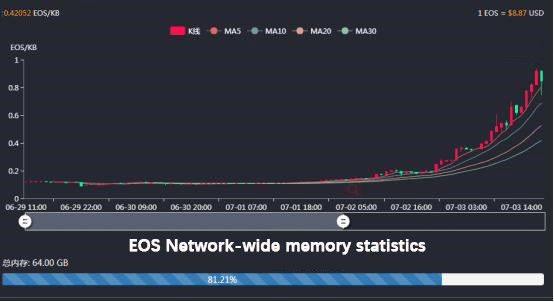

Therefore, when the distribution rate exceeds 80%, currently most memory is controlled by hoarders according to service rate.

2, RAM Speculators Who Squat

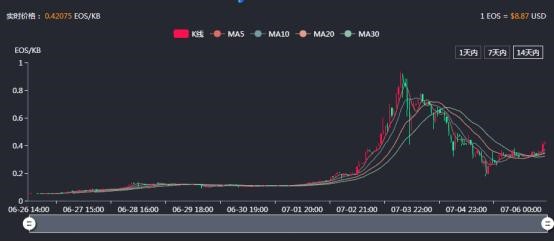

According to Bancor agreement, the more people who buy RAM, the bigger its value. Therefore, will gainful speculators let go of this chance? Of coursed not. There will be more and more chat groups for EOS memory on Wechat when RAM price roars. As more and more people supported RAM accordingly, and many speculators flooded in, the price of RAM surged to 0.9EOS/Kib.

Thomas Cox, former vice president of Block.one showed his worry about the surge of RAM price in the live speaking to Chinese Community on July 3rd. He believed that the high memory price may make it more difficult for application development, causing slower the innovation speed and stopping EOS ecology from developing.

While the Hach party believed that some developer still hoped to develop on EOS chains though the RAM price were surging. “RAM is not a consumable that can be reused. The capacity of EOS RAM can be enlarged through follow-up technologies, one anticipant from EOS program said to the HACH party. Some people believed that a side chain can be used due to the high cost of main chain development.

As time went by, Moore’s Law in the version EOS Dawn 4.0 will allow the super node become 4TB and even 16TB. The growth of this supply will lower the market price of RAM. Actually, it is up to the super node whether to enlarge the capacity. They will carry out a capacity enlargement plan when over two thirds of super nodes are feasible, specially explained BM.