Price of DRAM falls again, setting a record in recent nine years.

The latest survey reported by DRAMeXchange points out that DRAM industry is in oversupply. Most of the transactions have changed price monthly. Significant price downgrades are rare in February. It is estimated that the decline in the first quarter will expand from 25% to nearly 30%, the largest decline in a single quarter since 2011. DRAMeXchange also believed that if demand fails to rise, high inventories will lead to continuously cutting price this year.

In terms of the market, DRAMeXchange reports that contract prices began to fall in the fourth quarter of last year, and the inventory level continued to rise. Recently, the inventory of DRAM original factory has generally reached a high level of at least one and a half months. At the same time, Intel's CPU shortage is expected to continue until the end of the third quarter. PC-OEM is unable to digest supplier's DRAM due to the depressed demand. Therefore, the market is in an "infinite decline" dilemma.

For example, as the price of DRAM fell in the fourth quarter of last year, the total revenue of the world's major DRAM factories fell by 18.3%, and that of NANYA also decreased by 30.8% in the same quarter. What’s worse, Winbond and Powerchip showed double-digit decreases, so it is expected that the contract price will fall by nearly 30% in this quarter, and the revenue and profit of the major DRAM factories will continue to shrink.

Affected by the price reduction of DRAM in the first half of this year, the legal person predicts that the net profit per share of NANYA will fall from $1.9 last year to $1 or $1, a decrease of 40%. Previously, foreign capital that had been purchased for more than products of NANYA for a few days has also made a profit recently, selling a total of 257,700 copies in two consecutive days, while Winbond has oversold for four consecutive trading days, with a total of 9,339 copies.

DRAMeXchange also warms that Samsung, the world's leading company in DRAM, is afraid to launch a new price reduction offensive under the dual pressure of evidently eroded market share and relatively high inventory level, and that it is expected to deepen the decline of DRAM..

DRAMeXchange points out that due to the impact of the overall DRAM price decline, the profit highs of suppliers formally ended, and the business profit showed a recession.

DRAMeXchange believes that even if original factory is willing to reduce prices substantially in this case, it still cannot effectively stimulate sales. If demand does not rebound strongly, high inventory level will lead to DRAM prices continue to decline this year.

Three firms account for 95% of the market and memory is a boom cycle industry.

After the financial crisis, the market demand of DRAM industry is sluggish, and the oversupply of DRAM makes the price of products fall continuously. When the operation situation is very bad, the company must invest more funds in R&D in order to pursue higher advanced process. With the higher investment to competitive advanced process, DRAM industry immediately becomes a bottomless hole.

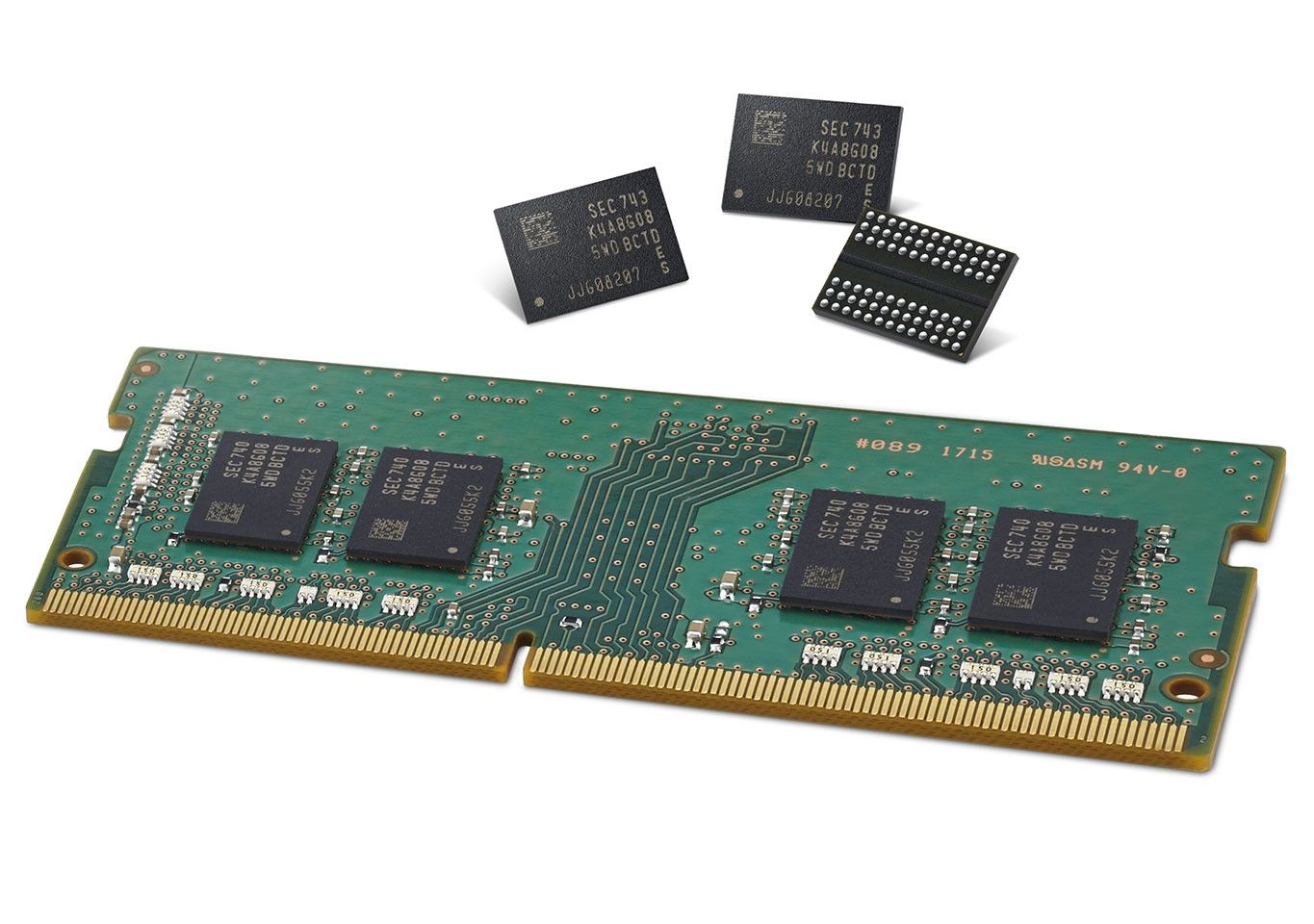

In order to survive the recession, DRAM companies have been sold and merged into large groups, for example ELPIDA in Japan and Inotera in Taiwan were merged into Micron. So far, only three large companies have survived, with a market share of up to 95%, namely Samsung (45%), SK Hynix(29%) and Micron(21%).

South Korea is the main base of DRAM factory. Depending on the advantage of high vertical integration within the group, it can also export products by its own brand and channel in bad market conditions, reduce the pressure of inventory at home, and continue to acquire memory factories trouble in difficult operation at abroad, which makes Samsung and SK Hynix have great advantages in DRAM industry.

Micron, ranked third, choses to plough deeply in Taiwan and cooperates with Taiwan's complete semiconductor supply chain. In order to compete with Korean giants, Micron also merges memory factories in Taiwan and Japan, resulting in an increasingly inseparable relationship between Micron and Taiwan. Finally, DRAM market has formed a tripartite situation.

With the development of memory industry, advanced granular R&D technology, talents and patents are in the hands of these three manufacturers. High competitiveness built abroad has made it difficult for new entrants to enter. The supply, demand and price of memory are determined by these three firms in this market, which results in the characteristics of memory industry boom cycle. According to the change of economic demand, the price of memory fluctuates with the supply adjustment of these three firms.

To prevent DRAM prices from falling again as they did a decade ago, the three firms will tacitly control output to maintain price levels by stopping expansion or production of some production lines to raise prices by lowering supply when prices are too low. When prices are too high, firms will choose to increase production to increase profits, so prices will gradually decline as supply increases.

But in fact, companies can quickly reduce production by reducing production in less than a week (or the so-called factory fire cease-production method), while expansion takes six months to a year to cover the factory and equipment and personnel need to prepare for production, so the speed of regulation of the two is different.

Such conditions make it difficult to regulate the supply and demand of memory market. Although it is an excellent situation for manufacturers to enjoy the huge revenue and profits brought by high prices for a long time, the legal problem of monopoly is the most difficult risk to deal with.

For example, the demand for memory market has increased dramatically from 2016 to 2018, but the supply has not kept pace with it. DRAM prices have risen with the rising demand and the revenue and profit of DRAM manufacturers have nearly doubled. However, the system factories were suffering from soaring cost, which indirectly leads to the high cost for downstream consumers to buy memory. Long-term development of the computer component market was not healthy, and at this point the Antitrust laws came.

In April 2018, Hagens Berman Law Firm in Unite States filed a class-action lawsuit against three DRAM factories, accusing them of limiting production, a typical of anti-monopoly and price fixing. On the other hand, Chinese government, which is actively developing DRAM industry, launched an anti-monopoly investigation against these three factories in the same year.

In 2019, the market suddenly flips that memory supply exceeded demand.

However, the prosperity only lasted until the second half of 2018. The supply and demand situation reversed in a short period of time. The first event was the collapse of the price of encrypted money market. The demand for increasing production of display cards needed for mining disappeared from the market in an instant. The crazy scene of empty sales turned into a mountain of inventory. How to digest the inventory at the end of the channel became the most distressed problem for display card dealers.

The next is that new factories built in 2017 and 2018 have started mass production, which can provide more memory output to the market. Until the second half of 2018, the production supply has stabilized, and the price of DRAM has gradually declined. But at this time, the market demand has sharply declined.

By early 2019, the market demand for data centers had cooled rapidly, partly because the data center market had been booming for two years, and the market was mostly saturated. In addition to Facebook, cloud vendors stopped building large-scale data centers, which led to a drop in memory prices for servers.

In addition, after mining tide, display card inventory has become a major problem. The existing competitive demand cannot digest these inventories at all. The mountainous inventory led to rapid decline of display VRAM orders.

Unfortunately, the growth of smart phones is also maturing in 2019. Apple's latest quarterly earnings report reveals that sales of the iPhone have declined by 15%. The sales of Android devices are expected to be even worse under poor sales indicators. With the overall slowdown in the memory market, the remaining capacity of memory factories will change to produce consumer memory. However, the original PC market is not large-scale. Now, there is a sudden influx of excessive supply, so the market is short-term oversupply. The rapid accumulation of inventory results in the current memory price collapse in an all-round way.

Fortunately, it is generally believed that market conditions will recover with increasing demand in the second half of the year, and that the shortage of Intel (INTC-US) CPU is expected to ease and gradually improve.

Regarding market situation this year, Li Peiying thinks that DRAM is conservative in the first half due to multiple factors such as global economic slowdown, trade war between the United States and China, tariff increase, supply chain adjustment and CPU shortage. When the third quarter enters traditional peak season, Intel's CPU shortage situation is expected to be eased in the second half of this year with the supply chain adjustment caused by the trade war between the United States and China.

Li Peiying believes that driven by the above factors, the market situation will certainly improve in the second half of the year, and demand will be better than in the first half.

According to Zhan Dongyi, general manager of Winbond, the market is full of uncertainties since the second half of last year. Access products began to regulate inventory. This trend is expected to continue until the first half of this year. However, terminal consumer demand is still healthy. Market inventory in the first half of this year is expected to be reduced to a reasonable level. At that time, terminal demand will be driven.