As both HDD and NAND prices falling, Western Digital loses $4.87 hundred billion

According to 2018 Q4 HDD market report released by a market research company, Trendfocus, quarterly shipment is between 88 million and 89 million, which falls below 90 million with 15-16% reduction indicating a further HDD market shrink. HDD market sliding is no longer news. One of three HDD gaints, Western Digital, gets into NAND market by purchasing Sandisk. Although Western Digital earns a lot in last two years with NAND price rising, it begins to have blue days due to price dropping of NAND flash memory in last year. According to 2019 Q2 financial report released by Western Digiatal today(calendar year is Q4 of 2018), its revenue is $4.2 billion with a 21% drop. It loses $4.87 hundred million. HDD shipments decline to 30.2 million. NAND flash memory shipments rise but its average price declines by 18%.

Western Digital has business of HDD and NAND flash memory after purchasing Sandisk. It used to recover HDD business by increasing NAND flash memory, but the situation changed in 2018. HDD shipment sliding won’t stop, what’s worse, NAND flash memory price drop stesses Western Digital. As Q1 revenue and profit of Western Digital previously slide, Q2 financial report even gets worse.

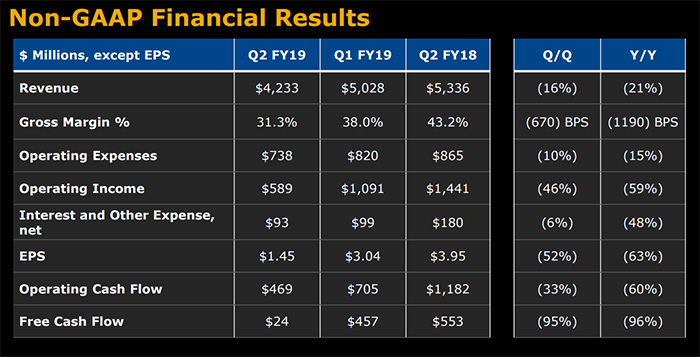

In the fiscal quarter ended December 28, 2019, Western Digital revenue is up to $4.2 billion, profit is $1.76 hundred million and net deficiency is $4.87 hundred million. Non-GAAP rules revenue is $4.233 billion, operating profit is $5.89 hundred million and net profit is $4.24 hundred million. Net deficiency is caused by adjustment of income tax and amortization of intangible assets.

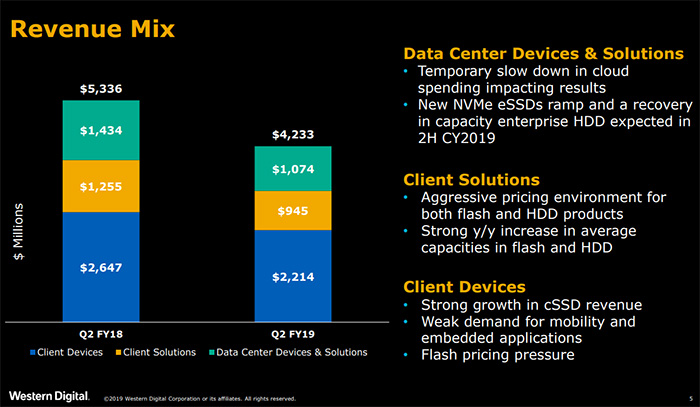

However, Western Digital sales falling off is a truth. Under non-GAAP rules, the $4.233 billion revenue has a 21% YoY decline and a 16% QoQ decline. Gross margin falls to 31.3% with a 6.7% drop compared with last quarter and a 11.9% YoY decline, which results in operating profit falling to $5.89 hundred million from $1.44 billion in the same period of last year with a 59% YoY slump and a 46% QoQ decline.

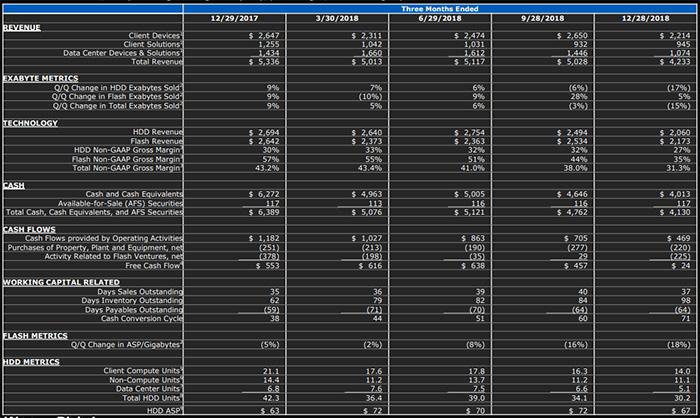

According to Western Digital financial report, sales slump is mainly caused by NAND flash memory price and HDD shipments slump. Although NAND flash memory rise, average price of ASP declines by 18% while HDD shipments only reach 30.2 million, which declines by 29% compared with 42.3 milllion in same period of last year and a 11.4% YoY decline.

More importantly, HDD market has a shipment slump recent years, but ASP average price keeps rising due to growth of enterprise-class and data center large-capacity hard dirve. However, HD average price is only $67 in Q4, which slide by $72 compared with last quarter exacerbating difficulties in Western Digital HDD business.