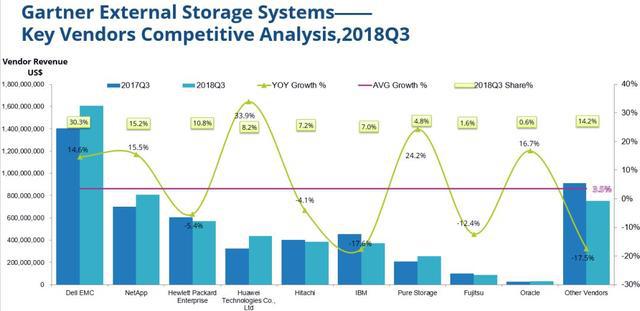

Huawei enters in TOP4 global companies for the first time from the diagram of Gartner’s 18Q3 external storage data

Gartner released its 18Q3 external storage data yesterday, some images are as follows.

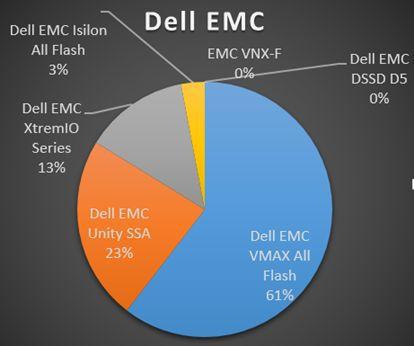

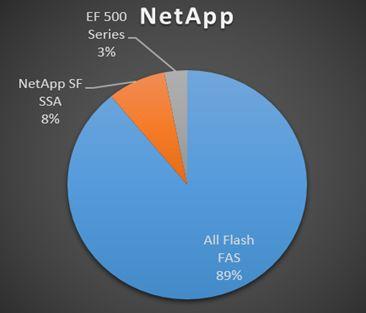

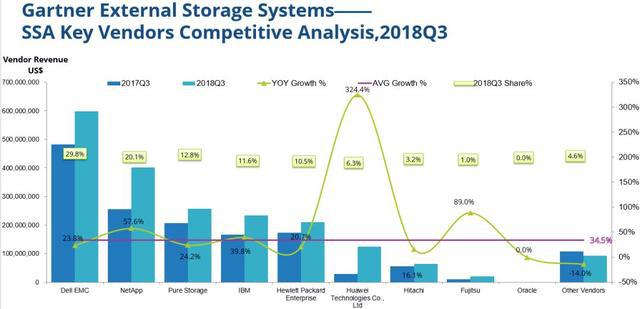

Global growth is 3.5% in total from the whole external storage situations. Dell EMC and NetApp are the first two companies who keep a rapid double-digit growth. HPE is the third one with earnings falling. Huawei with a highest 33.9% growth among TOP manufacturers exceeds IBM and Hitachi in earnings, ranking the global fourth. It is a best quarter for Huawei, who enters TOP4 with a highest growth.

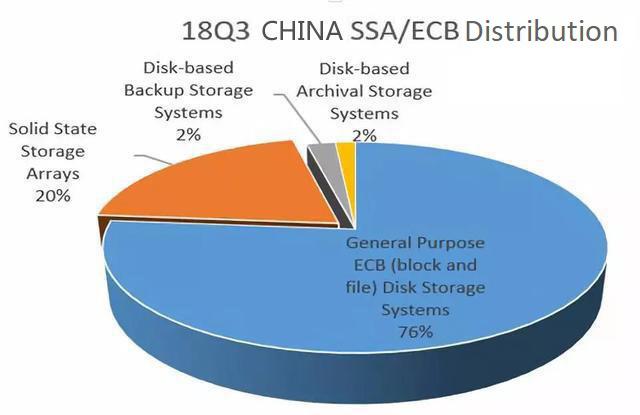

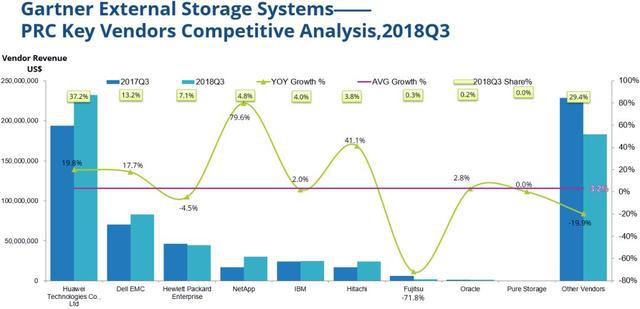

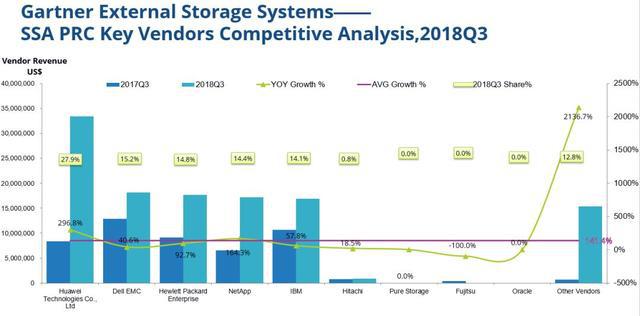

Situations of China are as follows after global looking. The external storage growth of China is 3.2% lower than global average. Huawei is the first with a 19.8% growth rate, which is much higher than average making its shares to be up to 37.2%. Dell EMC keeps a double-digit growth, ranking the second. Although HPE is the third, its earnings decreases. NetApp gets into TOP4 with a high growth rate.

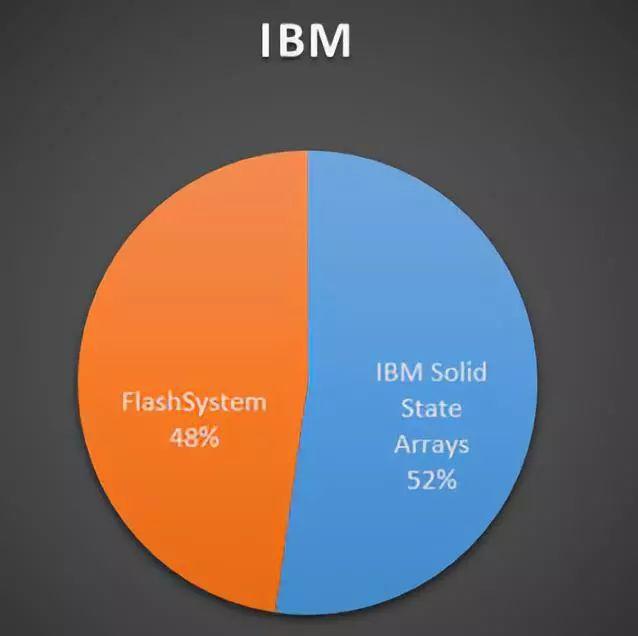

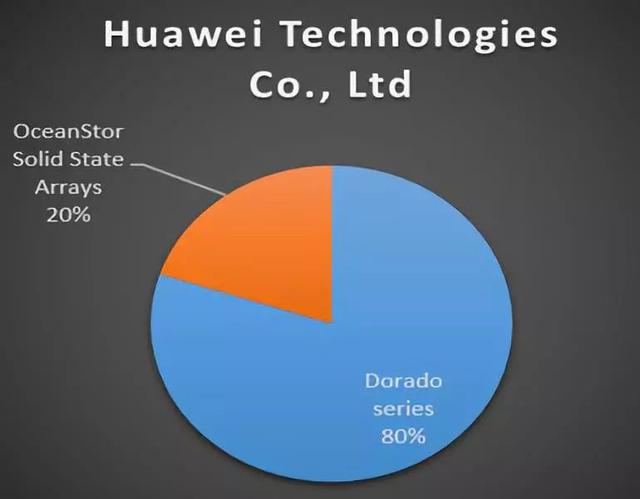

The data and ranking of SSA is similar to AFA data of IDC, except for the fourth and fifth. It is inspiring that if only look at Chinese companies in SSA, there is a holistic growth rate which is up to 141.4%. Huawei exceeds Dell EMC with a 296.% growth to rank the first, in addition, its shares are 27.9%. Dell EMC ranks the second but its growth rate is lower than average.

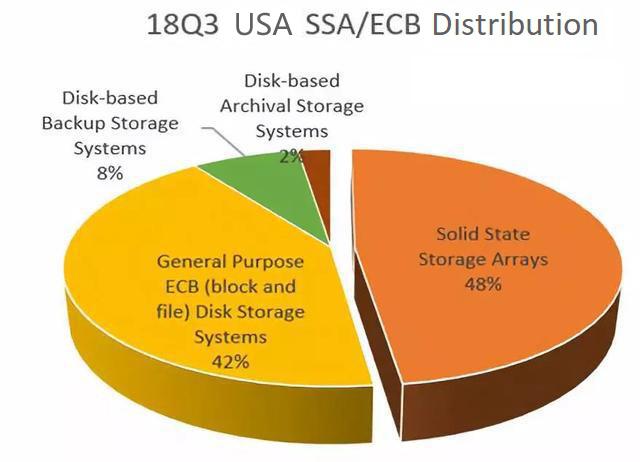

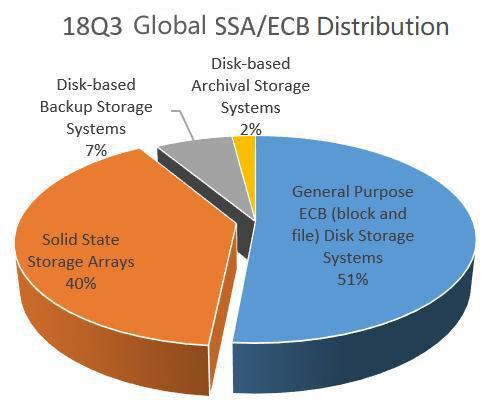

SSA occupies 40% of global ECB.

SSA holds 48% shares in America which is close to a half of market shares.