NAND manufacturers fight through 2018 with a substantial capacity growth and a 17% revenue reduction

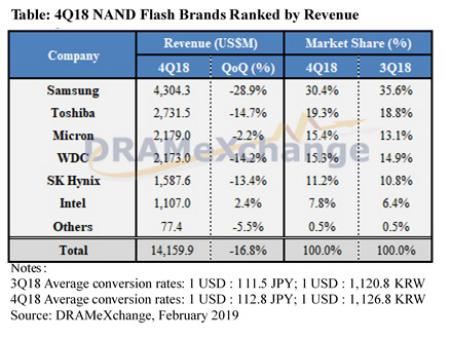

As memory prices falling by about 10% in last Q4, memeory manufacturers have a tough time with a profit collapse. Compared with NAND flash memory, memory is lucky. Flash memory prices have begun falling since early 2018 which last a whole year with average price drops by at least 50%. 1TB SSD prices halved in value. In this trend, the Q4 NAND revenue of last year is $14.16 billion with a 17% QoQ drop, while bit capacity of NAND flash memory increase by 40% all year around. However, because average prices fall the total revenue increases by 10.9%, $63.2 billion, according to a semiconductor research center of DRAMeXchange.

Detail of Dramexchange Technology’report is as follow:

According to global semiconductor research center, DRAMeXchange, some server manufacturers decide to put off stocking or cancle orders due to economic uncertainties of the fourth quarter in 2018. Meanwhile, upstream supply chian also adjusts production line, which stocks up in less products. Adding up poor shipment of new iPhone and weak demand in updating phone, Intel CPU stockout also impacts laptop demand lower than expected. Although average capacity are growing, whole bit shipment are lower than expected resulting in the brand revenue of the fourth quarter in 2018 reducing by 16.8% compared with last quarter.

Reviewing 2018 sales performance, although each product price are falling quarter by quarter, the whole year bit shipment increases by 40% compared with 2017. Growing total revenue comes to a new high, which is about $63.2 billion with a 10.9% growth compared with 2017.

The first quarter of 2019 comes into traditional off season leading to a weaker demand. Server and smart phone manufacturers continue adjusting inventory, NAND Flash bit shipment reduces compared with last quarter. Major suppliers maintain their market share by attracting customers with a more favorable price. As a result, NAND Flash is dragged by sliding of both sales the unit value fo sales and demand, keeping falling.

Samsung

Due to weakness of smartphone, server and laptop demand in 2018 Q4, Samsung bit shipment reduces by more than 7% compared with last quarter. As Samsung maintaining a high unit price before, the unit value of sales may fall in the fourth quarter, resulting average unit price declining by more than 20%. The fourth quarter revenue is $4.304 billion with a 28.9% reduction compared with last quarter.

Analysing process and capacity, 2019 project objective will keep focusing on 3D NAND capacity, because the impact of supply exceeds demand in NAND Flash market. 2D NAND capacity will reduce according to declining demand, but the prduction planning of fab in Pyeongtaek won’t change. Meanwhile, although the fifth generation of 3D NAND process yield is approaching maturity, Samsung will slow dwon the expanding plan to avoid overproducing.

SK Hynix

Because smartphone shipment is lower than expected, especially affeced by weakness of falgship smartphone sales and OEM destocking, SK Hynix’s bit shipment only increases by 10% in the fourth quarter of 2018. Adding up with factors such as server SSD purchase turning conservative, price reduction of further average unit of sales is up to 21%. The fourth quarter NAND Flash revenue is $1.587 billion with a 13.4% decline compared with last quarter.

In terms of capacity, SK Hynix will maintain its expanding planning of new fab M15 in 2019. Meanwhile, 96-layer 3D NAND products with new architecture are launched to improve cost and competitiveness, of which 96-layer UFS 2.1 products are predicted to have mass producton in the second quarter. However, 2019 main shipment will focus on 72-layer architecture before predicted products being launched after being imported for a period of time.

Toshiba

Because shipment of Apple’s new handset are worse than expected and stockout of laptop CPU, Toshiba’s bit shipment is barely falt in the fourth quarter of 2018, while kinds of contract prices obviously declining, which leads to average unit of sales declining by 15% compared with last quarter. Total revenue reaches $2.731 billion with a 14.7% drop compared with last quarter.

In terms of capacity, Toshiba’s capacity in Yokkaichi is asked to reduce by Western Digital, resulting a capacity reduction of the whole area. Expanding production focuses on Fab 6 in 2019, which is based on 64 layers.

Western Digital

Affected by Sino-US trade war, server and smartphone demand are worse than expectation. Although SSD shipment capacity has a good performance, bit shipment of the fourth quarter in 2018 only increases by 5% compared with last quarter. Average unit of sales declines by 18% compared with last quarter, which is affected by weakness of average unit of sales and further declining of various product prices. It results the total revenue declining to $2.173 billion with a 14.2% drop compared with last quarter.

In terms of capctiy planning, Western Digital will maintain capacity avstinece and capital expenditure strategy in the first half of 2019, which predicts 2019 bit outputs will be lowered by form 10% to 15% of original plan. Remarkably, it is critical for guarantee of competitiveness in the future, whether Western Digital will successfully take part in invesment of Toshiba’s new fab in Iwate-ken.

Micron

Micron maintains over 10% of bit growth in the fourth quarter, which thanks to SATA interface Enterprise SSD keeping a high quality and smoothly importing major smartphone clients by UFS and UMCP. However, Micron’s average unit of sales reduces by more than 10% because of falling NAND Flash prices. As a result, revenue falls to $2.179 billion with a 2.2% reduction.

In terms of capacity, Micron’s main bit growth of 2019 will be turned from process, which continues to importing 96-layer products. What’s more, it will maintain a bit growth close to level of industry.

Intel

Intel keeps a bit shipment growth over 15% because it has a leading advantage in server SSD together with clients upgrading higher capacity and more 64-layer products in the fourth quarter. However, due to contract prices reduction of server SSD, Intel’s average unit of sales redeces by between 10% and 20%. Total revenue slightly increases to $1.1107 billion with a 2.4% growth compared with last quarter.

In terms of capacity and process, Intel plans to expand the second phase of fab in Dalian to full load. In addition, proportion is expected to reach 30% of output in the second half of 2019 with 96-layer continually turning in.